Our New Market Realities

|

July has come to an end and given us better insight into our new market realities. We set a new high-water mark for monthly Sales Volume in the county at just over $1B (botton of Page 1) – a number that seemed unimaginable just a 5-6 years ago. However, we’ve been flirting with crossing the $1B line each year during our peak month (June or July) for the past couple of years… at this point is was essentially expected. While the slow and steady climb in Volume (and Units) has been mearching on, it hasn’t been without some indications that we are no longer in the heady post-COVID market that has been stubbornly hard to change since 2022. |

|

Looking at the Single Family Homes data (Page 2), it was another “strong” month, doing better than the year before in terms of Median Sale Price (up $20k from July 2024) and Inventory (up 1% from the previous year). However, the persistent indicators of market softening, Days on Market and # of New Pendings, continue to be in the red. The takeaway: Buyers are accepting more expensive listings than last year, but are demanding better condition for the price… the average home listed has not kept up with that shift in demand. 12.4% fewer listed homes went Under Contract this July (than last year), and took on average 1 day longer to get their offer. |

|

So… Is the selling party over? |

|

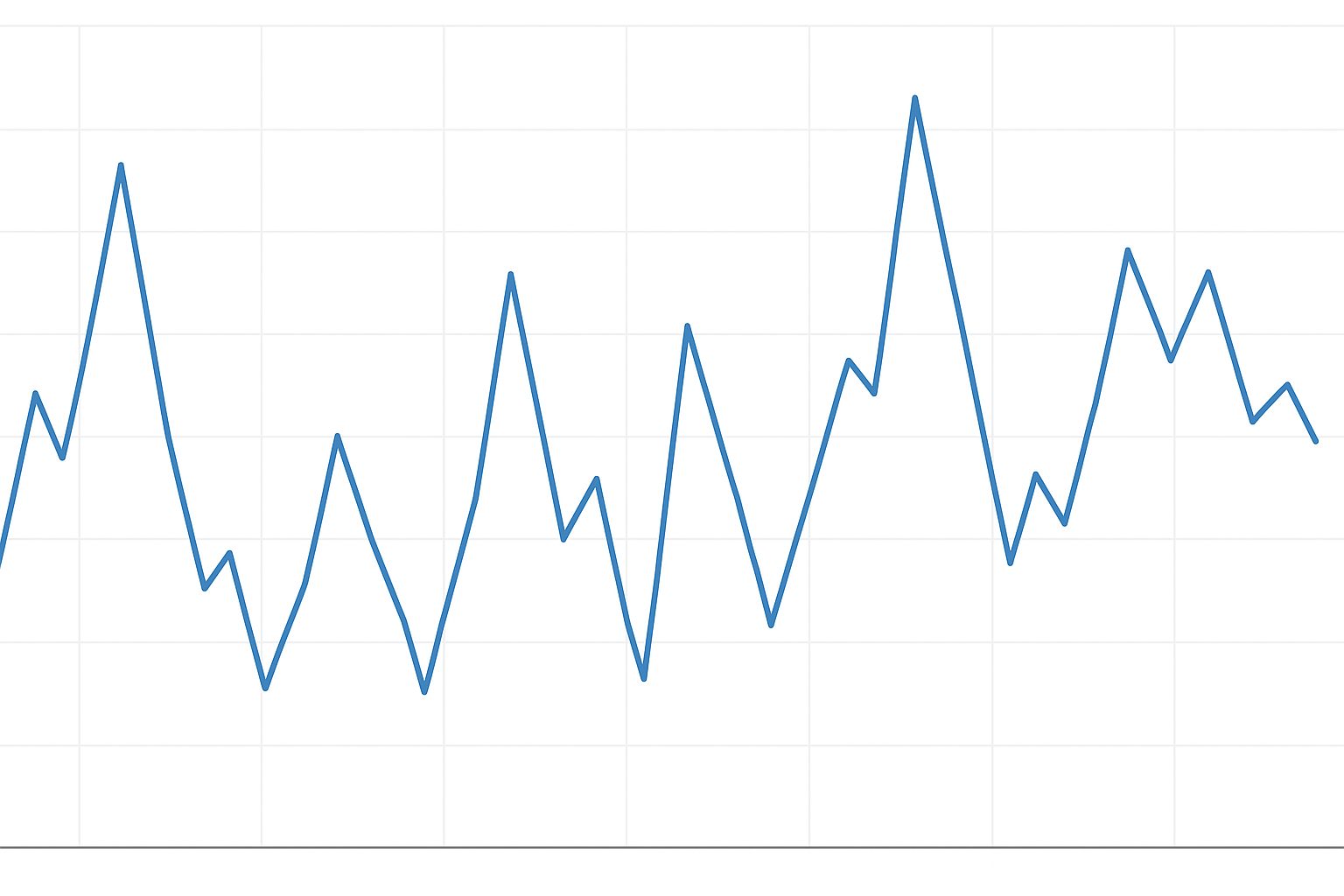

Our Single Family Homes New Pendings number has been yo-yo-ing the past few months. It was 13% below the previous year in May, looked a LOT stronger in June at a mere 5% behind the 2024 pace, and now looks notably worse yet again. As tempremental as this data has been, in pales in comparision to the volatility in the Condo Market (Page 3). We are all over the place with regards to New Pendings – and we currently find ourselves 20% (!!) behind last year. There’s definitely meat on the bone if you want to push a doom-and-gloom “the time to have sold your home was Q2 of this year” kind of narrative… but here’s the thing: Prices are still going up, Rents are still going up. I don’t think it is as simple as stating the best price you’ll acheive selling your home was 2 months ago. I DO think there’s nuance to our current market; the location / condition / and pricing of your home matters significantly more than it did last year. Let’s chat to discuss that nuance with your specific situation. |

|

And what about the best time to buy? |

|

Buying is likewise a challenge to pin-point. I guess if you don’t care what you buy, your best time to buy is December / January, when you’d close in January / February. Looking at the data from the last few years, January / February has been the timeframe when the lowest Median Home Sale Price has occurred for both Single Family and Condos. But here’s the caveat with that statement: sellers have been self-selecting. If they believed their home was capable of fetching a great price, they’ve been listing in the Spring when they’d be assured of the most buyers possible. So the properties that have been sold in January and February have not been the kinds of homes that the average buyer would be willing to pay top dolloar to obtain. That means, if you do care about what you buy, you’d want to stay AWAY from that time period, as there’s so little on the market and almost all of what is available would’nt interest you. Your best best would be to talk with me and discuss your specific needs and goals. I can help craft a strategy that includes apprpriate timing to find that needle in the (historically thin) haystack. |

|

A Big Thank You! |

|

For everyone who was able to come to the fire pit at Jennings Beach, thank you so much for attending and I hope you had a great time! For everyone else: don’t worry, I’ll be doing it again next year – hope to see you there! |

|

As always, I’m looking forward to connecting. |

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link